Blockbuster BeiGene Cancer Drug Adds Another FDA Approval

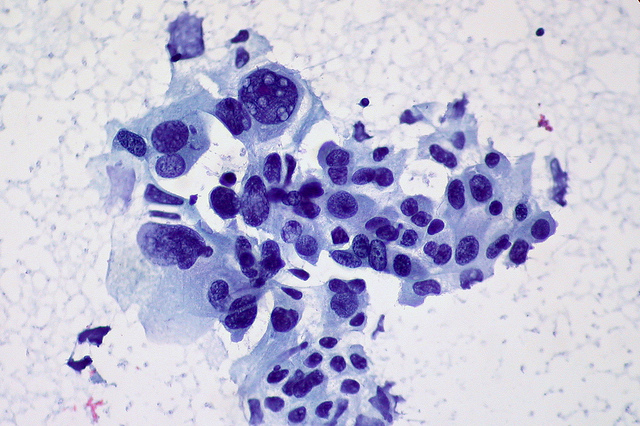

The FDA approved BeiGene’s Brukinsa as a treatment for advanced cases of follicular lymphoma. It’s the fifth FDA nod for the drug, which has become BeiGene’s top-selling product.

The FDA approved BeiGene’s Brukinsa as a treatment for advanced cases of follicular lymphoma. It’s the fifth FDA nod for the drug, which has become BeiGene’s top-selling product.

BeiGene is expanding its cancer drug pipeline, landing global rights to an Ensem Therapeutics cancer drug candidate ready to enter the clinic. The drug targets CDK2, an enzyme whose excessive activity is associated with cancer progression.

BeiGene welcomes the return of the immunotherapy’s rights as an opportunity to make it the backbone of its solid tumors strategy. But Novartis cedes an opportunity to gain a competitor to established cancer immunotherapies from Merck and Bristol Myers Squibb.

Novartis and BeiGene ended their partnership on a cancer immunotherapy for a target called TIGIT. Though BeiGene describes the termination as mutual, it comes before Novartis would need to pump more money into the alliance even as questions linger about TIGIT as a cancer target.

The FDA has deferred a regulatory decision on an esophageal cancer drug from partners BeiGene and Novartis, citing the need to complete inspections of the China-based facilities where the drug is made. The agency said Covid-19 travel restrictions have prevented it from conducting those inspections.

Novartis is partnering with BeiGene on the development of a drug that addresses TIGIT, a hot cancer immunotherapy target. The Swiss pharma giant is committing $300 million up front, and up to $700 million more upon exercising its option on BeiGene's antibody drug.

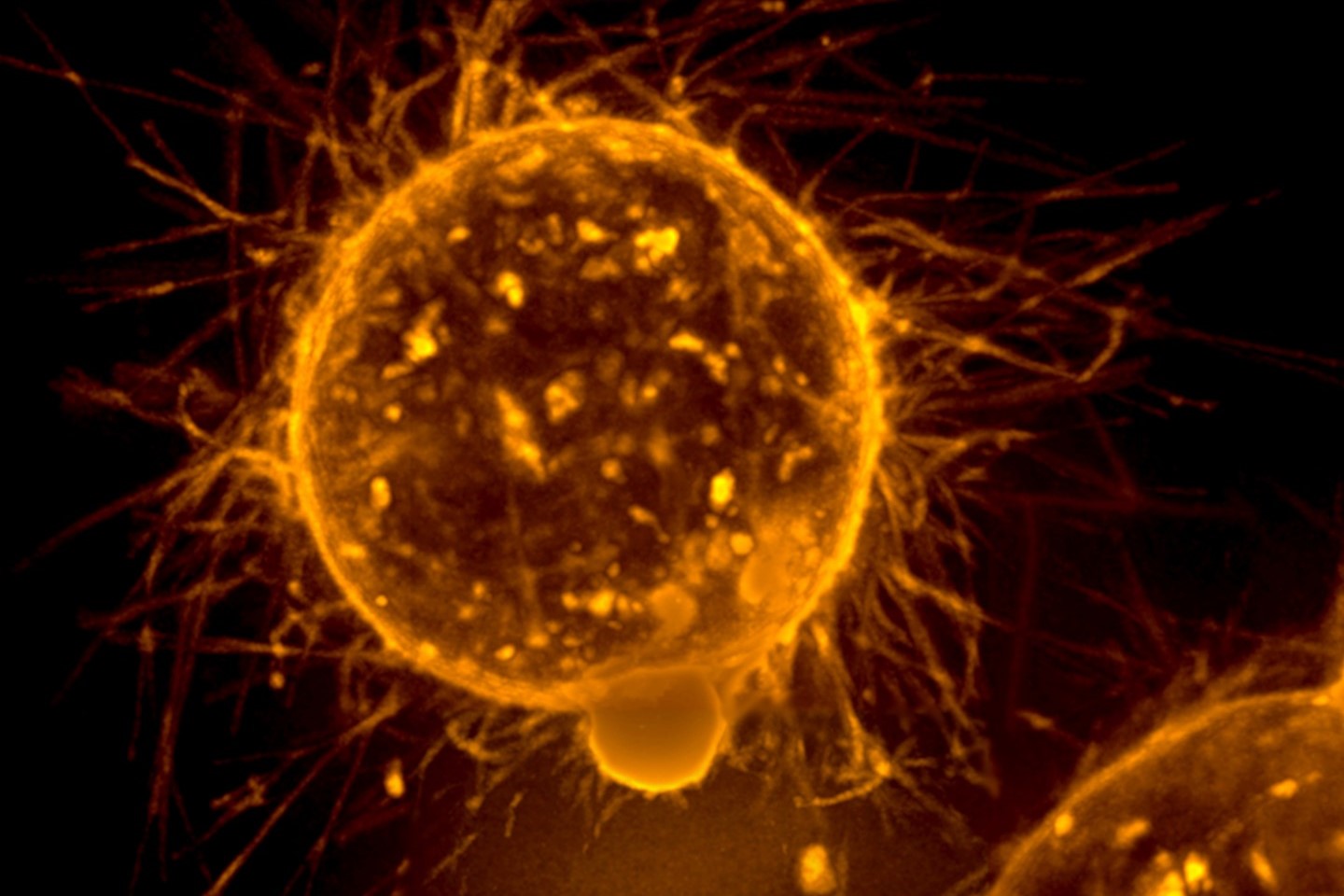

Gilead Sciences and BeiGene, which started research alliances with Shoreline Biosciences earlier this year, are among the investors in the biotech's latest financing. The preclinical-stage company's technology develops cell therapies for cancer by using natural killer cells.

The San Diego-based biopharma firm has several oncology therapies in development and has partnered in the past with the likes of Astellas, BeiGene and Bristol-Myers Squibb.

Although it didn't disclose data for the study, the Beijing-based biotech company said it planned to seek Chinese approval for tislelizumab in first-line, non-squamous non-small-cell lung cancer. The drug is in several Phase III trials, including in the U.S.

The Phase III study showed that BeiGene's Brukinsa outperformed AbbVie and J&J's Imbruvica on safety. An analyst wrote that FDA approval on that basis is unlikely, but off-label prescribing is possible. Brukinsa won approval for another blood cancer last month.

In a landscape where complexity has long been the norm, the power of one lies not just in unification, but in intelligence and automation.

Under the deal, BeiGene will help Amgen commercialize its oncology drugs in China, while Amgen will acquire slightly more than one-fifth of the Beijing-based firm. BeiGene will also participate in R&D efforts on 20 drugs in Amgen's oncology portfolio.

Celgene had been expected to hand the PD-1 checkpoint inhibitor tislelizumab back over to the Chinese company due to its $74 billion acquisition by Bristol-Myers Squibb, which already has its own well-established PD-1 inhibitor, Opdivo.

In an interview at the ASCO meeting, BeiGene chief adviser Eric Hedrick said the company is well-prepared for when it likely regains global rights to tislelizumab.

While zanubrutinib showed a higher response rate in the same mantle cell lymphoma setting for which Imbruvica is approved, the Phase II study enrolled younger, less heavily pretreated patients than those in Imbruvica's pivotal trial.

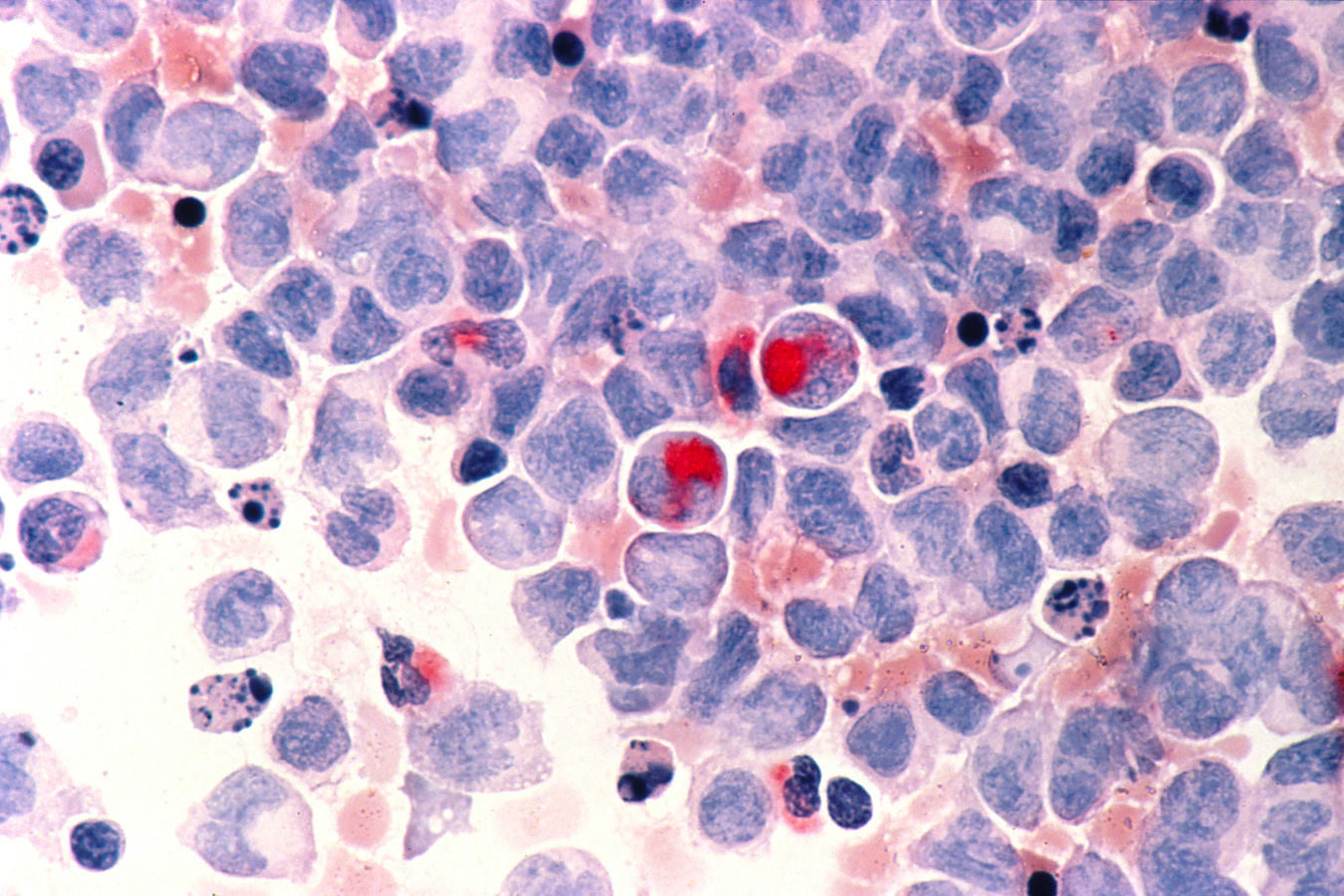

Chinese cancer immunotherapy player BeiGene just filed a $100 IPO with the U.S. Securities Exchange Commission to advance its clinical pipeline of BTK, RAF and PARP inhibitors.